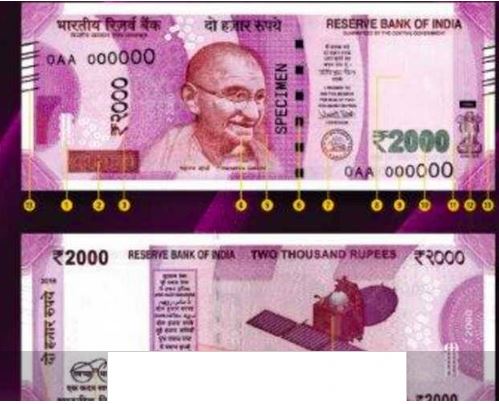

The Reserve Bank of India (RBI) announced on Friday that it will withdraw 2000 rupee notes from circulation. The notes will continue to be legal tender, but they will no longer be accepted as legal tender after September 30, 2023.

The RBI said that the decision to withdraw the 2000 rupee notes was taken in order to “curb the menace of counterfeit currency and to promote digital transactions.” The central bank also said that the withdrawal of the notes would help to “make the Indian currency more secure and efficient.”

The announcement of the withdrawal of the 2000 rupee notes has been met with mixed reactions. Some people have welcomed the decision, saying that it will help to curb the use of counterfeit currency and promote digital transactions. Others have criticized the decision, saying that it will inconvenience people and disrupt the economy.

The RBI has said that it will provide adequate time for people to exchange their 2000 rupee notes for other denominations. People will be able to exchange their notes at banks and post offices until September 30, 2023. After that date, the notes will no longer be accepted as legal tender.

The withdrawal of the 2000 rupee notes is the latest in a series of measures that the RBI has taken in recent years to combat counterfeit currency and promote digital transactions. In 2016, the RBI withdrew 500 and 1000 rupee notes from circulation in a move that was known as “demonetization.” The demonetization drive was successful in curbing the use of counterfeit currency, but it also caused a great deal of inconvenience to people.

The withdrawal of the 2000 rupee notes is likely to have a similar impact on the economy. It is likely to cause some inconvenience to people, but it is also likely to help to curb the use of counterfeit currency and promote digital transactions.

The RBI has said that it will monitor the impact of the withdrawal of the 2000 rupee notes and take further steps if necessary.

Impact of the Withdrawal of the 2000 Rupee Notes

The withdrawal of the 2000 rupee notes is likely to have a number of impacts on the Indian economy.

Curbing the use of counterfeit currency: The withdrawal of the 2000 rupee notes will make it more difficult for counterfeiters to produce fake notes. This is because the notes are more difficult to counterfeit than the older 500 and 1000 rupee notes.

Promoting digital transactions: The withdrawal of the 2000 rupee notes is likely to encourage people to use digital transactions more often. This is because digital transactions are more convenient and secure than cash transactions.

Inconvenience to people: The withdrawal of the 2000 rupee notes is likely to cause some inconvenience to people. This is because people will have to exchange their notes for other denominations before September 30, 2023.

Disruption to the economy: The withdrawal of the 2000 rupee notes is likely to disrupt the economy to some extent. This is because people will have to adjust to using digital transactions more often.

The RBI has said that it will monitor the impact of the withdrawal of the 2000 rupee notes and take further steps if necessary.

Conclusion

The withdrawal of the 2000 rupee notes is a significant step by the RBI. It is a move that is likely to have a number of impacts on the Indian economy. The RBI has said that it will monitor the impact of the withdrawal of the notes and take further steps if necessary.

AKHILAM Women's Shimmer Organza Sequence Embroidery Saree With Unstitched Blouse Piece

₹999.00 (as of March 7, 2026 18:04 GMT +05:30 - More infoProduct prices and availability are accurate as of the date/time indicated and are subject to change. Any price and availability information displayed on [relevant Amazon Site(s), as applicable] at the time of purchase will apply to the purchase of this product.)EthnicJunction Women's Art Silk Kalamkari Print Saree With Blouse Piece

₹429.00 (as of March 7, 2026 18:04 GMT +05:30 - More infoProduct prices and availability are accurate as of the date/time indicated and are subject to change. Any price and availability information displayed on [relevant Amazon Site(s), as applicable] at the time of purchase will apply to the purchase of this product.)Yashika Women's Trendy Banarasi Kanjivaram Navy Color Art Silk Saree with Blouse Material

₹444.00 (as of March 7, 2026 18:04 GMT +05:30 - More infoProduct prices and availability are accurate as of the date/time indicated and are subject to change. Any price and availability information displayed on [relevant Amazon Site(s), as applicable] at the time of purchase will apply to the purchase of this product.)Sidhidata Women's Georgette Digital Printed Ready To Wear one Minute Saree With Unstitched Blouse Piece

₹966.00 (as of March 7, 2026 18:04 GMT +05:30 - More infoProduct prices and availability are accurate as of the date/time indicated and are subject to change. Any price and availability information displayed on [relevant Amazon Site(s), as applicable] at the time of purchase will apply to the purchase of this product.)VJ Fashion Women Woven Soft Silk Saree With Blouse Piece_freesize

₹499.00 (as of March 7, 2026 18:04 GMT +05:30 - More infoProduct prices and availability are accurate as of the date/time indicated and are subject to change. Any price and availability information displayed on [relevant Amazon Site(s), as applicable] at the time of purchase will apply to the purchase of this product.)Discover more from Jharkhand Weekly - Leading News Portal

Subscribe to get the latest posts sent to your email.